Monday, March 26, 2007

Financing / Insurance

2. LOAN REFINANCING. Remain Name&NCB,fast approva-l, all type of cars,vans&lo-rry. 012-6055011/ 012-6335515

3.AUTO REFINANCE (AMCB) remain name&NCB,90% loan, tenor 7-9yrs,car&van. 410889 81/2,Rizal 016-3708192,Alex 0 12-3083528,Fauzi 019-3143601

4.CAR FINANCING. Up to 16 years old. Genuine customer only. Call Man 03 - 6187 1160 / 013 - 352 2890 now!!!

5. REFINANCE (YOUR Car/commercial vehicle for cash) No transfer of name & NCD remains. Immediate cash payment. 24 hrs approval for Govt servant. Low interest rate & charges. Authorised dealer for Arab - Malaysian Credit. Khoo 012-202 3388 / 019-950 9988. Angeline 012-286 3343

6. AUTO FINANCE /Refinance. Car/MPV/SUV Van for Cash. Vehicle up to 12years. Name & NCB remain. Fast approval & low int. Fair Deal (Arab M'sian Credit Authorised Dealer). 012-314 9966 Zarina

7.AUTO REFINANCE Scheme 24 hours disbursement, Ownership & NCD remains. Lower monthly installements. Low interest rate, repayment up to 9 years. Financing up to 12 years old vehicle. Contact Nisha 012-3922947, Jeeva 012-3298312, Sariful 017-2096877, Off. 03-2691

Boost up with Mr Turbo

Woon Keam Sang, 56, likes it that way. It’s a catchy monicker that sells what he’s good at – installing turbochargers and tuning engines to extract maximum performance.

The man is quite handy with superchargers, too. He has been doing what he loves since the 1980s, and in the process, putting a grin on customers’ faces.

A turbocharger, however, is run by exhaust gases driving a turbine, while a supercharger gets its power from the engine’s crankshaft via a belt or chain. The usual boost from either device is 0.5 bar, which boils down to a 30% to 40% power gain after innate inefficiencies are factored into the equation.

Woon, by his own admission, is a self-taught expert.

“I wanted to challenge myself . . . see how far I could go. What I know now, I learnt from books and a lot of hands-on sessions.

“When you put in a super/turbocharger in a naturally aspirated car, you can see a great deal of difference in the performance.

“With a super(charger),” he says, “you get a lot of low-end torque. The power comes very early.”

On the other hand, a turbocharger is known for delivering boost when the engine is running at higher rpms. But it’s not all clear cut.

It comes down to the settings.

“If you use a smaller turbo, it behaves like a super in the sense that the extra power comes in early, say at 2,000rpm, and goes off early as well.”

People go for turbos for various reasons and it’s not just to race or go fast. It can be safer for the driver if he has a slightly more powerful car especially when overtaking.

Citing a close call, Woon recalls: “I used to work on a lot of cars from out of town at one time, so I was bringing back a customer’s Nissan Sentra, fitted with an SR20 turbo, from Terengganu late one night. There were no lights on the road. I was overtaking a trailer.

“Suddenly, I saw a black object up ahead. It was then I realised a lorry was coming at me without its headlights on.

“I panicked. I was passing the trailer and it was too late to pull back. The only option was to speed up and luckily the car had the power to haul me out of danger.”

After every turbo installation, Woon says he always advises the customer to handle his car carefully until he is familiar with the new settings before going fast.

It takes a week to 10 days for a typical installation. A new turbo/supercharger, at RM5,000-RM6,000, is simply too expensive for the crowd Drager Racing Motorsports caters to, so it relies on reconditioned ones to do the job just as well. Each costs only a few hundred ringgit and comes with a limited warranty.

With greater boost comes a need for more modifications to ensure the car can handle the power safely and effectively.

For those who desire 1.5-1.8 bar, a major upgrade to such parts as the pistons, conrods, crankshafts, clutch, brakes and suspension is necessary.

Woon has read of some extreme installations overseas where the boost was as much as 4.2 bar.

Various configurations are possible including twin turbos or even a superturbo setup that comprises a supercharger and a turbocharger.

Woon, in fact, is currently working on a superturbo installation for a Satria GTi customer that should offer strong torque across a wide power band.

These days, Woon has passed the baton to his son Andy who carries on the family trade. But as long as he is able, Woon figures he will remain on the turbo scene which has become such a pivotal part of his world. – GEORGE WONG

Drager Racing Motorsports is located at 536, Jalan 20, Taman Perindustrian Ehsan Jaya, Kepong, Kuala Lumpur. They can be contacted at tel: 03-6275 4508 or 019-2636 927.

Smaller spare, bigger space

When it comes to shopping for a new car, consider the factors that Malaysians deem important – style, price, resale value, prestige, fuel economy, colour, comfort, safety, low maintenance, etc. But do you know of anyone choosing a car because it has a great spare tyre?

That may change if the Consumer Association of Penang (CAP) has its way. On Thursday its president, S.M. Mohamed Idris, claimed that the temporary use spare tyres that many cars are equipped with today pose a danger if they were not used in accordance with the car manufacturers’ instructions.

He has a point. Temporary use spare tyres and wheels are narrower and lighter than the other four standard wheels and tyres. So, they are not as strong, nor are they as good in all the other areas that tyres are expected to be good in, including grip and resistance to damage from road hazards.

There are two types of space-saver tyres – full size temporary spares that are narrower but have the same height as the standard tyres, and compact temporary spares that are not only narrower but smaller in diameter as well.

The latter pose an additional risk because a car will end up having one tyre smaller than the other three, which could affect stability.

Most European and many Japanese cars now come with space-savers while the popular local cars that use them include the Proton Waja and Savvy and Perodua's Myvi.

So, why would safety conscious carmakers specify such wheels if they are potentially dangerous?

More space, less waste

The primary aim of space-savers is to maximise space and minimise weight, the latter being a significant factor in reducing fuel consumption.

In coming up with specifications, the challenge that car designers face is to find the optimum balance between space that is usable every day and fuel economy that is beneficial every minute that the vehicle is running – and a spare tyre that is likely to be needed only once or twice in several years.

“The benefit that space-saver tyres bring is that they provide greater luggage capacity and improve flexibility of the interior space of vehicles,” says Ford Malaysia managing director Michael Pease.

“Space-saver tires have been used and approved by many (car) manufacturers globally for more than a decade now. When these tyres are used in accordance with manufacturer's specification, they have been demonstrated to be reliable and dependable.”

The key point is “used in accordance with manufacturer’s specification.”

Alternatives

There are other solutions to the perennial problem of punctures.

BMW, for example, has decided that the spare tyre is obsolete and is working towards offering cars fitted only with extended mobility or “run-flat” tyres that can be driven on even when punctured. Some other manufacturers offer these tyres as options.

When engineers invest so much time, effort and money to shave “mere grammes” from hundreds of components, it is absurd to lug around 20kg or so of spare tyre that’s rarely needed, according to BMW Group Malaysia managing director Wolfgang Schlimme.

Run-flats sound like the ideal way to go but they have limitations, too. They can be used only on cars equipped with an onboard tyre pressure monitoring system (otherwise, the driver may not be aware when a tyre is punctured).

While BMW insists that its suspension systems are tuned for run-flats, many drivers still feel that standard tyres offer a more comfortable ride.

There are also constraints on how fast and far run-flats can run without air, and the ultimate put-off may be that they cost 50-100% more than comparable conventional tyres.

Another option is some kind of temporary repair or sealing system, and inflation using either an electrically operated pump or compressed air and sealant stored in canisters.

These, too, have disadvantages; the tyre can be too severely damaged to re-inflate, or a simple valve failure can leave you stranded. The canisters have a finite lifespan, too.

The best may be the run-flat but, as with all good things, it comes at a price that many can’t or won’t pay. The cheapest in the long run is probably the space-saver, used appropriately and checked regularly.

Monday, March 5, 2007

Reduced fines for certain traffic offences only

However, the Transport Ministry objected to the idea and the Cabinet ordered the cops to reinstate the old fines.

The latest is that a compromise has been reached between the cops and the ministry to allow reduction for minor and not-so-dangerous offences only, according to this report filed by The Star's Sim Leoi Leoi. Read on.

PUTRAJAYA: There will be no reduction in compounds for five serious traffic offences — speeding, queue jumping, beating traffic lights, overtaking on a double line and driving on the emergency lane.

Transport Minister Datuk Seri Chan Kong Choy said the Road Transport Department (JPJ) and police had agreed that there should be no compound reduction on these offences, which posed a danger to other motorists.

He said this after a meeting with officials from JPJ, the Road Safety Department, the police, the Internal Security Ministry and City Hall here yesterday. It was the first meeting to be held after last Wednesday’s Cabinet decision to postpone a proposal by the police to slash traffic compounds by as much as RM200.

The police had earlier insisted that it had the power to reduce the compounds without having to consult the Transport Ministry.

Chan said the authorities would meet later to streamline the rates of compounds for other offences such as illegal U-turns and parking, wrong-doings involving driving licences and the non-wearing of helmets by motorcyclists.

“We agreed that the streamlining of these rates would involve some form of reduction. However, we decided there should be no reduction for the five serious offences, as they pose a danger to other motorists,” he added.

“It’s important that the right message is conveyed and that drivers must be disciplined regarding these five offences.”

At present, JPJ’s compound rates for traffic offences are higher by as much as RM100 than those meted out by the police.

Chan said both the JPJ and the police had two weeks to come up with the new compound rates for other offences which he would submit to the Cabinet for approval.

Later, when approached, newly-appointed Inspector-General of Police Tan Sri Musa Hassan said the motive behind the initial proposal to slash traffic compounds by the police was good.

“But the implementation was not right,” he conceded, insisting there had been “no breakdown in communication” between the different ministries.

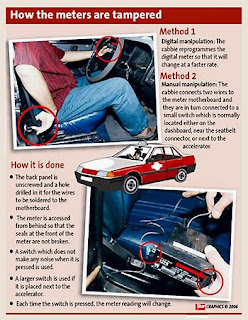

Taxi Cheat

Well, The Star did a bit of legwork and got a cabbie to confess to the scam perpetrated by his dishonest fellow drivers.

According to the report http://www.thestar.com.my/news/story.asp?file=/2006/9/24/nation/15529061&sec=nation&focus=1, two methods are used to fleece unsuspecting commuters.

One way is to reprogramme the digital meter so that the fare will change at a much faster rate, and the other is install a hidden switch that will increase the fare whenever it is pressed by the taxi driver.

The life of a taxi driver may be tough but should this be justified through cheating innocent consumers?

We are watching you

Under the Transport Ministry's Automated Enforcement System project, more than 700 surveillance cameras will be set up at strategic points like traffic light junctions, on tall buildings in all cities round the country, and at accident-prone roads and highways.

The project, which has been approved by the Cabinet, is aimed at enforcing traffic regulations, and reducing accidents and fatalities.

More on the story from The Star's Ng Si Hooi on this link http://thestar.com.my/news/story.asp?file=/2006/9/27/nation/15547766&sec=nation&focus=1

Would we be seeing more disciplined and courteous motorists from now on?

Citizen traffic wardens

CALLING all motorists and vehicle passengers with camera handphones or digital cameras.

The Road Transport Department wants you to become their citizen traffic wardens this festive season by sending pictures or videos of traffic offenders.

According to The Star report, the move may help increase road safety as motorists who are about to commit offences would think twice especially when there would be someone recording the event and forwarding the evidence to the authorities for action.

Looks like the level road courtesy on Malaysian roads is going to go up.

Top safety marks for Audi Q7

WHEN it comes to safety on the road, its usually the bigger the better.

Big, safe and good looking too

And Audi's latest behemoth - the Q7sports utility vehicle, which was launched in Malaysia in September - proves this point.

The seven-seater SUV received top rating of five stars for two separate tests by National Highway Transport Safety Administration (NHTSA), the US highway safety authority.

This result certifies the all-wheel drive Q7 as one of the safest vehicles in its category in the opinion of the US safety experts.

The Q7 also received a four-star rating for rollover safety, the best score of any SUV.

The performance SUV built was put through two high-load crash tests by the NHTSA - a frontal collision at 35 mph (56kph), and a side-on collision through a mobile barrier moving at a speed of 38.5 mph (62kph).

These tough test requirements of the NHTSA are even more demanding than the legal requirements in the US.

The values recorded by the testers for both the driver and the front passenger of the Q7 in frontal and side-on collisions nevertheless satisfy the criteria for a five-star rating in every respect.

Besides scoring high marks in crash tests, the Q7 also boasts exemplary standards of active safety features.

It is equipped with the latest-generation electronic stability programme with brake assist, hill-start assist and rollover stabilisation as standard items.

Other available active safety features include the lane-changing monitor Audi side assist and the latest generation of adaptive cruise control, Audi cruise control with braking guard, which slows the Q7 right down to a standstill if need be.

Anyway, Euromobil Sdn Bhd, the local distributor of Audi cars, is offering the Q7 in two engine options - the 3.0-litre turbo-diesel direction injection at RM580,000 and the 4.2-litre fuel stratified injection at RM750,000.

Thursday, February 22, 2007

MNI Insurance

Motor Insurance

When you own As a responsible motorist, you should consider Choose from our three different packages |

Motor Insurance

To put it simply,

Motor Vehicle Insurance is insurance for cars

and other vehicles. It insures the vehicle against

damages or loss.

While driving is not necessarily a dangerous

activity, accidents do occur. If that happens,

it is the responsibility of the owner of the vehicle,

or driver, to be able to meet any claims made against them. To ensure that they're able to fulfil

that responsibility, Motor Vehicle Insurance is

used.

Click here for more information

Accident Protection Plan

When it comes to accidents, you

are probably more worried about the injury suffered

by your passengers rather than your car. After

all, the car can be repaired or restored, but

maybe not a human body. This is why we've introduced

the Car Accident Protection Plan - a plan that

is designed to protect you and your passengers

against any injury caused by an accident whilst

travelling in a private vehicle. In addition,

it also provides emergency assistance and emergency

medical evacuation within Malaysia.

Click here for

more information.

of MNI Insurance Panel Workshops, please

click

here.

Wednesday, February 21, 2007

What you should do in the event of an accident/loss

- Take notes of the accident – If you are involved in a motor accident, take

notes of the accident, i.e. the names and addresses of all drivers and

passengers involved, vehicle registration numbers, make and model of each

vehicle involved, the drivers’ licence numbers and insurance identification as

well as the names and addresses of as many witnesses as possible.

- Make a police report – You are required by law to lodge a police report within

24 hours of a road accident.

- Notify your insurance company – You must notify your insurance company in

writing with full details as soon as possible. Depending on the type of claim you

intend to make, you may have to notify other insurance companies (please refer

to ‘ Making a claim against an insurance company’ for details). If you fail to

report the accident, you will be liable for your own loss as well as any third party

claim against you.

- Select the workshop – You must send your damaged vehicle to a workshop

approved by your insurance company. If the accident occurs during office

hours, you may call the hotline/ emergency assistance numbers provided by

your insurance company. Otherwise, you may call your insurance company for

the nearest approved workshop. Should the accident occur outside office hours

and you are making a claim against your policy, i.e. an own damage claim, you

should ensure that your vehicle is towed to a workshop approved under the

Persatuan Insuran Am Malaysia Approved Repairers Scheme [called a PIAM

Approved Repairers Scheme (PARS)]. If you are making a third party claim, it is

advisable to also send your vehicle to a PARS workshop.

Important points to note when buying motor insurance cover

If you are buying a policy against loss/damage to your vehicle, you must ensure that your vehicle is adequately insured as it will affect the amount you can claim in the event of loss/damage. For a new vehicle, the insured value will be the purchase price while for other vehicles, the insured value is the market value of the vehicle at the point you apply for the insurance policy.

·Under-insurance –

If you insure your vehicle at a lower sum than its market value, you will be deemed as self-insured for the difference, i.e. in the event of loss/damage, you will only be partially compensated (up to the proportion of insurance) by your insurance company.

· Over-insurance –

Should you insure your vehicle at a higher sum than its market value, the maximum compensation you will receive is the market value of the vehicle as the policy owner cannot ‘profit’ from a motor insurance claim.

Duty of disclosure

You should disclose fully all material facts, including previous accidents (if any), modification to engines, etc. When in doubt as to whether a fact is relevant or not, it is best to ask your insurance company. If you fail to disclose any material fact, your insurance company may refuse to pay your claim or any claim made by a third party against you. In such cases, you are personally liable for such claims.

Price

The price you pay for your motor insurance will depend on the type of policy selected. The insurance premium charged by your insurance company is the standard minimum rate in accordance with the Motor Tariff.However, in addition to the standard minimum rate, your insurance company may impose additional premiums known as loadings to the premium payable in view of higher risk factors involved such as age of vehicle and claims experience. Loadings are governed by Bank Negara Malaysia (BNM) and no insurance company may charge loadings higher than the levels permitted by BNM.

No-claim-discount

The premium payable may be reduced if you have no-claim-discount (NCD) entitlement. NCD is a ‘reward’ scheme for you if no claim was made against your policy during the preceding 12 months of policy. Different NCD rates are applicable for different classes of vehicles. For a private car, the scale of NCD ranges from 25% to 55% as provided in the policy.

Excess

Also known as a ‘deductible’. This is the amount of loss you have to bear before your insurance company will pay for the balance of your vehicle damage claim. The types of excess applicable are as follows:

·Compulsory excess of RM400 –

if your vehicle is driven by a person not named in your policy or a person named in your policy who is under the age of 21, the holder of a provisional (L) driving licence or the holder of a full driving licence of less than two years.

· Other excess –

applicable at the discretion of your insurance company and in some cases, no excess is imposed. You can negotiate with your insurance company on this excess.

Insurance cover note/policy

When you purchase a motor policy, you will usually get a cover note. You should check your personal details as well as details of vehicle, insurance and premiums. Within one month from the date of cover note issuance, you should receive:

·the Schedule which shows your name and address, details of the vehicle, the sum insured (for comprehensive and third party fire & theft policies), the period of insurance, the policy number, your NCD entitlement, premium breakdown, excess and named drivers;

·the certificate of insurance which shows your name, vehicle model, registration number and cubic capacity, period of insurance, authorised drivers and limitations of use. In some cases, this may be issued at the point of purchase in place of the cover note; and

· a motor policy which shows the terms and conditions of cover provided by your insurance company.

If you do not receive your policy within one month, you should check with your insurance company.

Exclusions/extensions

Types of motor insurance policies

·Third party cover - This policy insures you against claims for bodily injuries or deaths caused to other persons (known as the third party), as well as loss or damage to third party property caused by your vehicle.

·Third party, fire and theft cover - This policy provides insurance against claims for third party bodily injury and death, third party property loss or damage, and loss or damage to your own vehicle due to accidental fire or theft.

· Comprehensive cover - This policy provides the widest coverage, i.e. third party bodily injury and death, third party property loss or damage and loss or damage to your own vehicle due to accidental fire, theft or an accident.

Tuesday, February 20, 2007

Allianz Malaysia Motor Insurance

Types of Cover

Comprehensive Features

- Loss or damage to the insured vehicle and its accessories and spare parts.

- Liability for damage to others vehicle and property caused by insured vehicle

- Legal Liability for death or bodily injury to any third party person

Under comprehensive cover the following benefits are available for an additional premium:- Windscreen

- Strike, Riot & Civil Commotion (SRCC)

- Flood, typhoon or other convulsion of nature

- Legal Liability of Passengers (LLP)

- Legal Liability to non-fare paying passengers (LLNP)

- Additional Driver

Third Party, Fire & Theft Features

- Legal Liability for death or bodily injury to any third party

- Legal liability to third party property loss or damage

- Loss or damage to the insured vehicle as a result of fire and theft

Third Party Liability Only Features

SPY Ultimate Security System 2007 MODELSPACE

Are simply the most advance Security systems ever!.

Car Alarm Features :

- Random Code ( Learning Code / Delete Code )

- 3 Button Transmitter

- Open Door Warning ( Warning For Door Unclosed Well )

- Central Lock System Automatically

- Car Finding - Panic ( High Sensitivity )

- Engine Cut Off- Roadside Park Warning

- Anti-Fault Trigger ( Trigger Mode ID Function )

- Auto - Arm Function Option ( Arm Warning / Arm / Rearm )

- BLUE Led Display

- 2 Remote Controllers

- Far Distance Remote Range Package consist of:2 x Remote Control1 x Computer Chip Box 1 x Complete Wiring Kit1 x Installation Diagram

Only RM 180. Read More

AAM Lube Service

AAM Membership...

Pay Through Hong Leong

Welcome

This common way of purchasing a new or used car is known as hire purchase service.For hire purchase, it is offered by most of the major financial institutions in Malaysia, some of these financial institutions include local and international banks.

Hire purchase is actually the hiring of goods where in the future, the hirer (consumer) will have the option to purchase and own the goods once all of the installments have been fully paid.

Before the installments are fully paid, the financial institution which leases the payment for the car will retain the ownership of the car until when the installments are fully paid by the leaser.

Besides car, most of the consumer items for household or personal usage and as well as vehicles like taxis and buses can be purchased via the option of hire purchase. The minimum deposit for hire purchase will be nothing less than 10% of the cash price of the vehicle. However, the rate of 10% may vary between different financial institutions and in some cases, the rate may be significantly higher than 10%.

As for the payable interest rate, the financial institution can charge an annual interest rate no more than 10% and in addition to that, the interest rate that is charged by the financial institution will remain fixed over the entire hire purchase tenure. Lastly, there are two ways where a consumer can acquire the hire purchase services.

One of the way if by dealing it directly with a finance company whereas the other method is to apply for the hire purchase service via a dealer, such as a motor vehicle dealer.